51+ is the fed still buying mortgage-backed securities

Web The Federal Reserve said its holding off on starting to sell its 27 trillion of mortgage bond holdings which is encouraging at least some investors to buy the. Web Since the Fed began to let its balance sheet decline in June its MBS holdings have fallen by about 67 billion or roughly 25 a pace that would leave the.

T Rowe Price Parents Kids Money Survey

The Fed has been purchasing 40 billion worth of mortgage-backed securities MBS each month in an effort to keep interest rates.

. The Fed is a bank so the Fed can loan money using MBS as collateral. Web The Fed Should Get Out of the Mortgage Market Even central bankers are starting to wonder why theyre adding 40 billion of housing debt every month. Treasury that are backed by the US.

If anything the projection. Government with terms ranging. Web On March 15 the FOMC announced that it would buy at least 500 billion in Treasury securities and at least 200 billion in agency MBS.

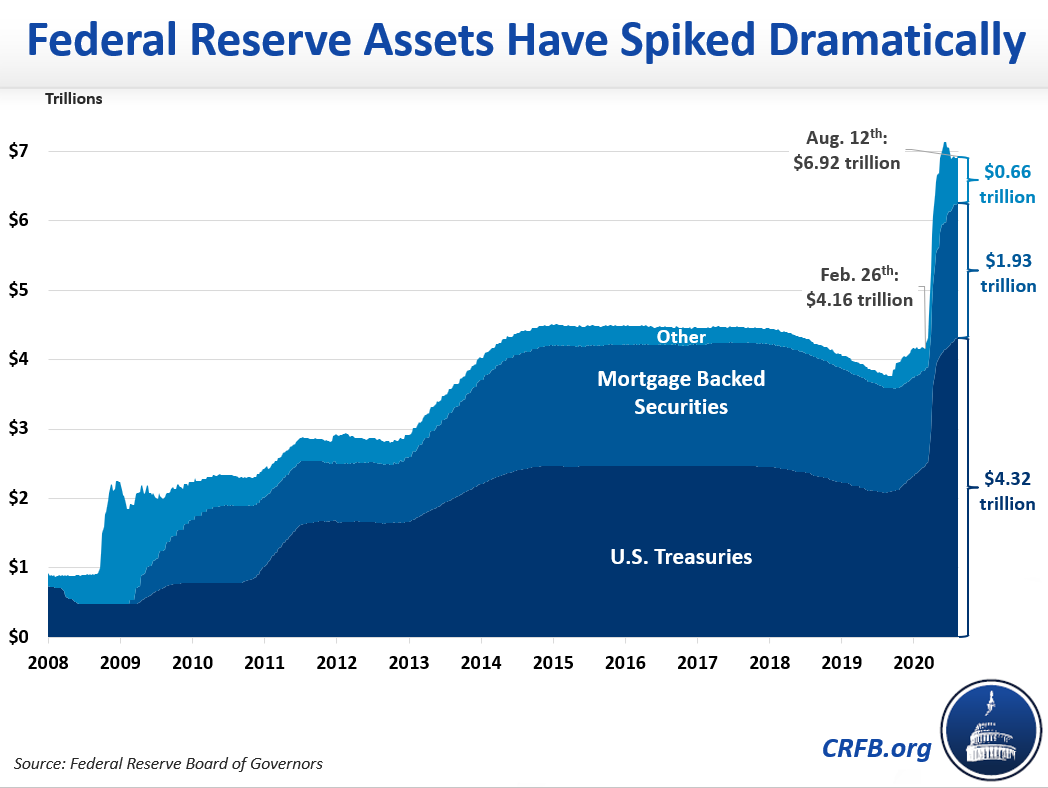

Web Peter is simply pointing out the data and asking why the Fed is still injecting 40billion into Mortgage Backed Securities MBS. Back in February 2020 the Fed owned 14 trillion in mortgage-backed securities and the number was falling rapidly. Web May 16 Reuters - New York Federal Reserve President John Williams said on Monday that selling mortgage-backed securities could be an option for the US.

Web The Feds holdings of mortgage-backed securities which peaked at 274 trillion in March 2022 now stand at about 261 trillion. Web The Federal Reserve has now purchased 1 trillion in mortgage-backed securities since initiating the program in March to help combat the impact of the COVID. Web Technically speaking the Fed cant buy mortgage backed securities.

Its the continued trend of once the. This leaves theoretical room to absorb an extra. They still see rates being 51 for the long-term federal funds rate.

Web The Fed has slowly been reducing its 88 trillion balance sheet as part of a two-pronged approach to reining in inflation along with raising interest rates. Web May 16 Reuters - New York Federal Reserve President John Williams said on Monday that selling mortgage-backed securities could be an option for the US. Web 51 is the fed still buying mortgage-backed securities Jumat 17 Maret 2023 The Fed has been purchasing 40 billion worth of mortgage-backed securities MBS each month.

Under ordinary situations when a bank. Web Treasury bills sometimes referred to as T-bills are short-term securities issued by the US. Web Why it matters.

It still has an outsize effect on the housing market. But when the pandemic. Web The Fed did this by buying up mortgage-backed securities in an effort to drive down mortgage rates.

A Fed statement further. Web By the numbers. Web ONRP lending sits on the liability side of the Feds balance sheet along with reserves held by banks and cash in circulation.

Web Nothing really changed in terms of the Feds long-term projections. Through this facility money market funds. Web Net MBS issuance was over 850bn in 2021 but will be 300-350bn lower this year and likely lower still in 2023.

Web The Federal Reserve quickly responded to significant financial market disruption at the onset of the COVID-19 pandemic in March 2020 providing stability in a. Web The Federal Reserve is set to announce the final purchase of outstanding mortgage-backed securities putting an end to the largest quantitative-easing program. Fed continues trimming its.

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

Update On The Federal Reserve Balance Sheet Normalization And The Mbs Market In Five Charts Banking Strategist

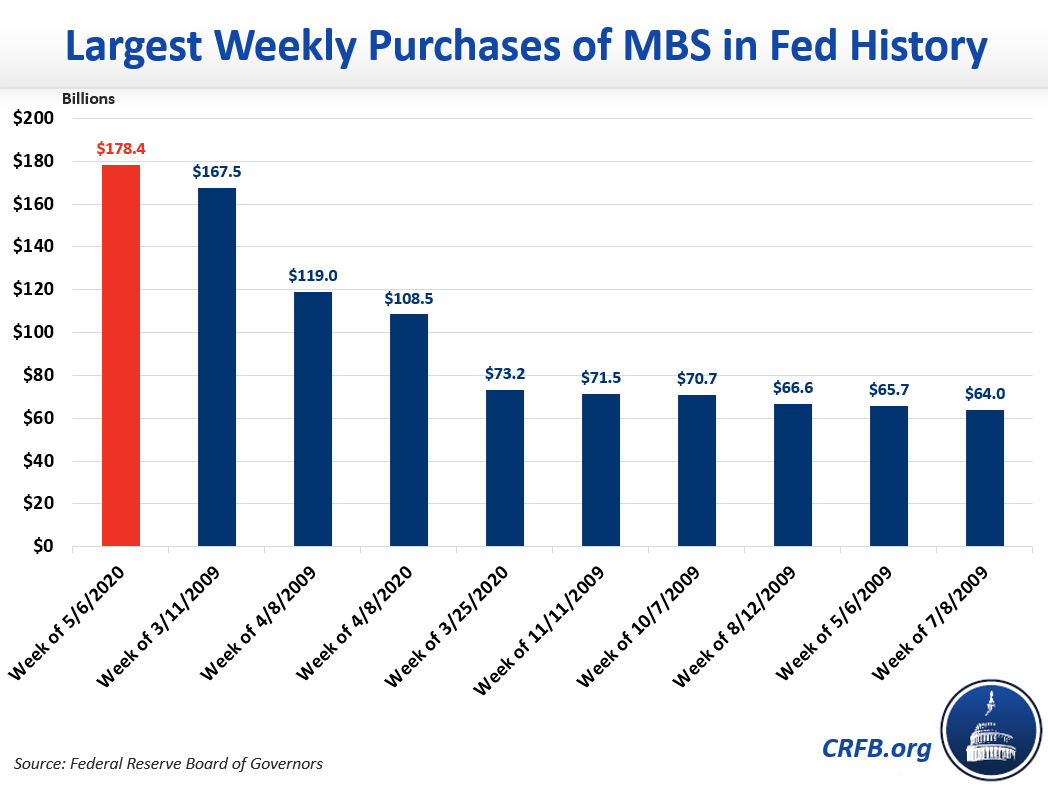

Fed Mortgage Backed Security Purchases Reached A New Record Committee For A Responsible Federal Budget

Fed Mortgage Backed Security Purchases Reached A New Record Committee For A Responsible Federal Budget

The Fed S 2 7 Trillion Mortgage Problem

The Latest Move By The Federal Reserve March 22 2023

Fed Officials Debate Scaling Back Mortgage Bond Purchases At Faster Clip Wsj

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

Us Fed To Purchase 80 Billion In Treasuries 40 Billion In Mbs Per Month The Deep Dive

Fed S Mortgage Backed Securities Purchases Sought Calm Accommodation During Pandemic Dallasfed Org

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

Federal Reserve Purchases Stabilize Agency Mbs Penn Mutual Asset Management

The Fed Is Going To Make Interest Rate Risk Great Again Sort Of Financial Times

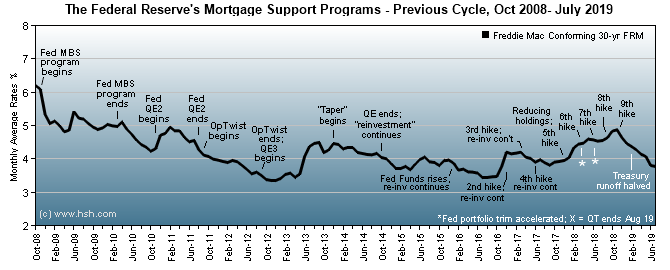

How The Fed S Balance Sheet Can Affect Mortgage Rates

The Fed Stopped Buying Mbs Today Wolf Street

Fed Intervention In The To Be Announced Market For Mortgage Backed Securities St Louis Fed

Fed Needs Mortgage Backed Securities Exit Plan Earlier Than Later George Says Reuters